FRM考试临近,感觉来不及?

如何拨开云雾见月明?FRM考前冲刺竞赛来啦!FRM考前精选题型

用数月有余的备考时间拯救你即将崩塌的小心脏!

竞答须知:

1.本期竞赛共计10道题,答题、打卡及邀请皆可获取积分。

2.每期竞赛积分排行榜前10名有机会抽取高小吉公仔一只。连续三期排行榜第一名赠送FRM官方指定考试专用计算器一个。

3.本期答题即日起至10月18号23点59分截止,请大家在活动期间参与答题。

4.答题仅限实名制参与,每人仅限一次提交机会,如若发现作弊,取消活动资格。

5.活动等相关问题,请添加微信高顿Herman(ID:Chinese

frm)咨询。

6.一切活动解释权归高顿FRM所有。

第一题

Answer:A

Solution:

VAR is an ex-ante measure of risk.Notional limits cannot be aggregated across assets.An exposure limit is not a predictive risk management measure.A stop-loss limit seeks to eliminate a position after a cumulative loss threshold is exceeded.

第二题

Answer:A

Solution:

σportfolio=[W12σ12+W2σ2+2W1W2σ1σ2r1,2]iven r1,2=+1

σ=[W12σ12+W22σ22+2W1W2σ1σ2]1/2=(W1σ1+W2σ2)2]1/2

σ=(W1σ1+W2σ2)=(0.3)(0.3)+(0.7)(0.4)=0.09+0.28=0.37

第三题

Answer:C

Solution:

Reducing correlation between the two assets results in the efficient frontier expanding to the left and possibly slightly upward.This reflects the influence of correlation on reducing portfolio risk.

第四题

Answer:A

第五题

Answer:C

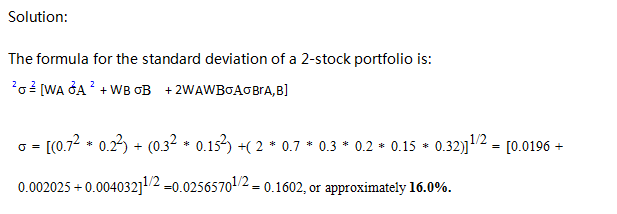

Solution:

The variance of the portfolio is found by:

[W1σ1+W2σ2+2W1W2σ1σ2r1,2],or[(0.15)(0.0071)+(0.85)(0.0008)+(2)(0.15)(0.85)(0.0843)(0.0283)(0.04)]=0.0007.

第六题

Answer:D

Solution:

Since the stocks,are perfectly correlated,there is no benefit from diversification.So,invest in the stock with the lowest risk.

第七题

Answer:C

Solution:

The portfolio possibilities curve is concave above the minimum variance portfolio and convex below the minimum variance portfolio.

第八题

Answer:A

Solution:

Since the portfolio is well diversified,the assumed level of unsystematic risk is zero.The addition of ABC Inc will increase the portfolio beta,and,hence,the level of systematic risk.

第九题

Answer:A

Solution:

k=5+1.10(10-5)

=5+1.10(5)

=5+5.5

=10.5

第十题

Answer:D

Solution:

The general form of the two-factor APT model is:E(RPort)=RF+βinterest RP interest+βGNP RPGNP,where theβare the factor risk premiums and the RP are the portfolio’s factor sensitivities.Substituting the appropriate values,we have:

RPort=0.03+0.02(−1.2)+0.03(0.80)=3.0%

如有更多疑问,欢迎扫描下方二维码,添加我的个人微信号“frmer2019”为好友,私信于我!